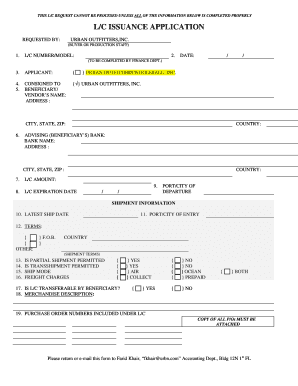

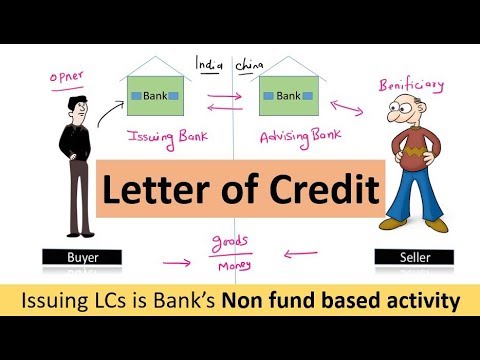

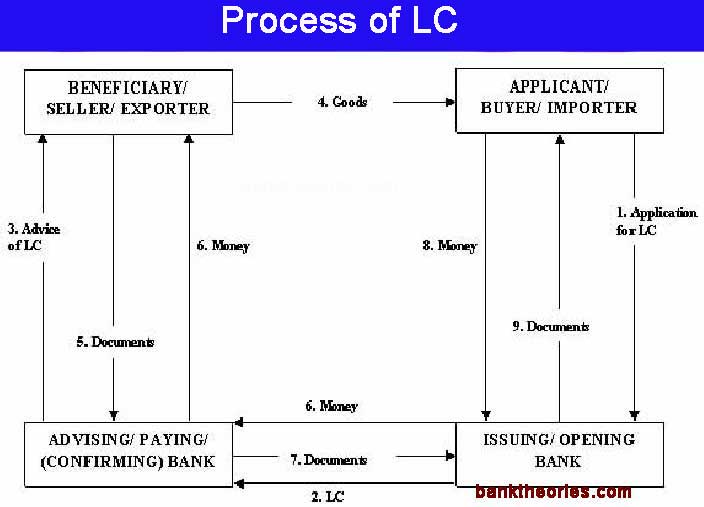

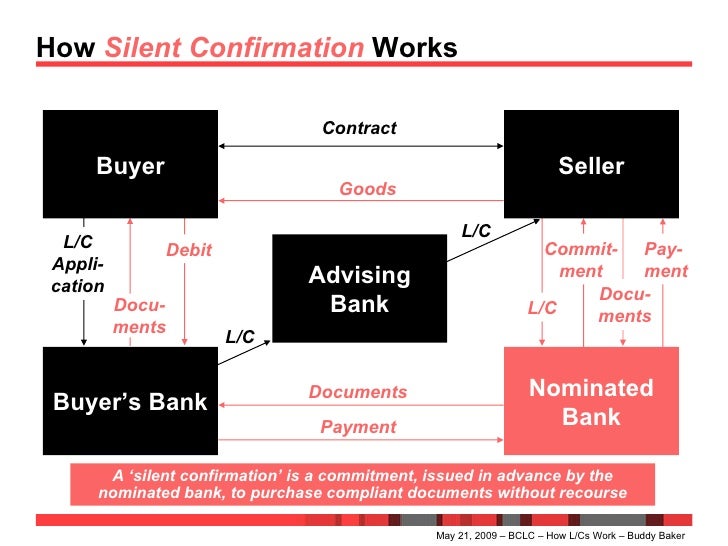

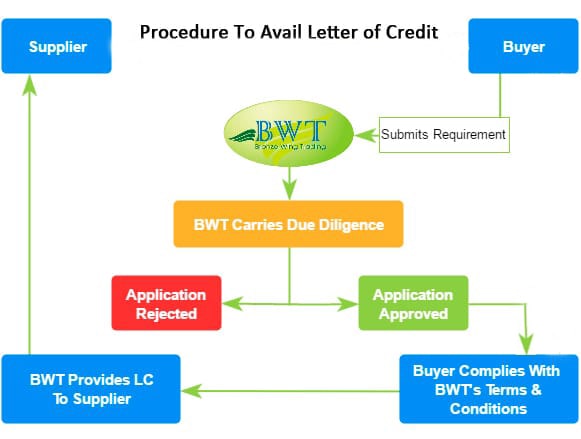

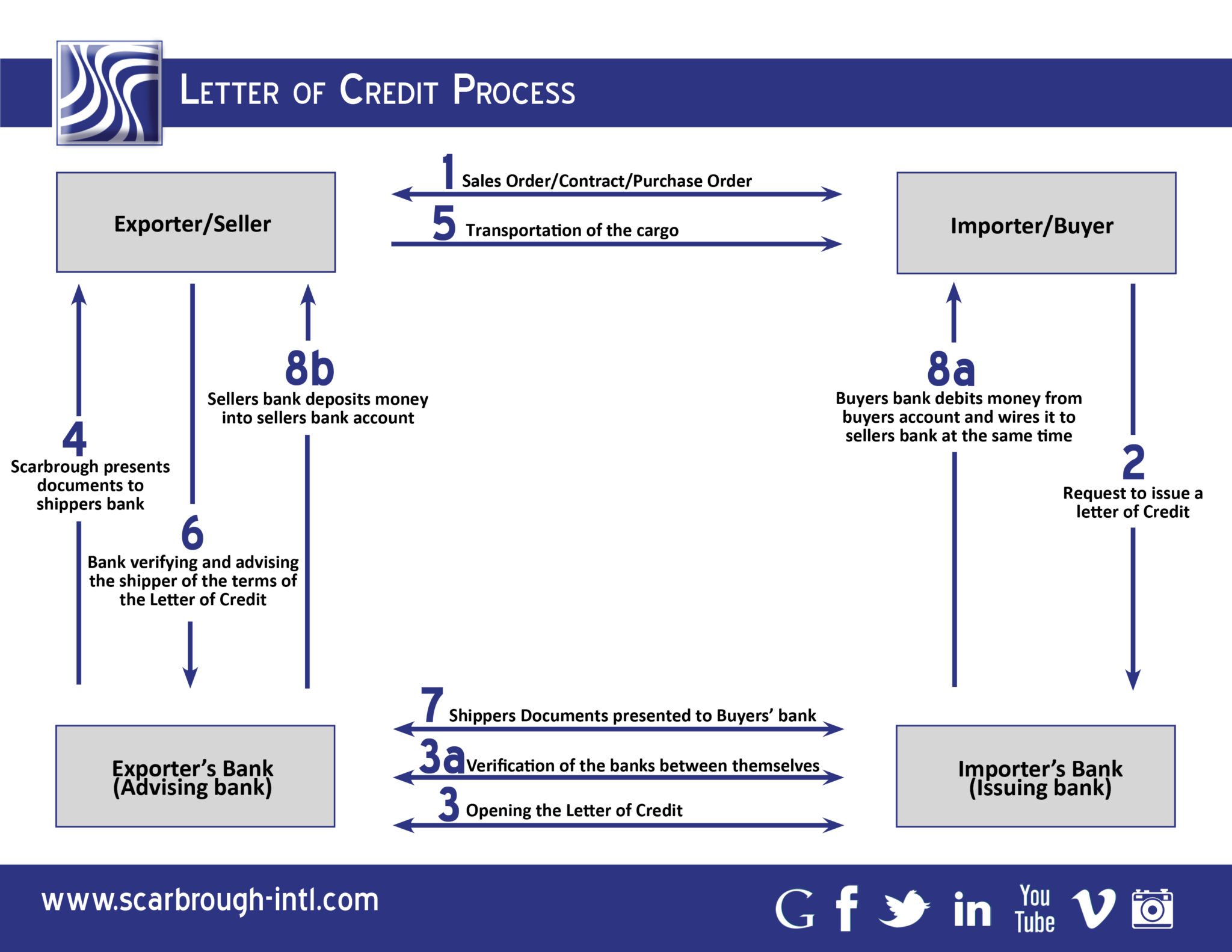

How To Get Lc From Bank. For seller protection, if the buyer is Again for buyer protection if delivery does not happen then the buyer gets his payment by using A restricted LC is that one wherein the specific bank is designated to pay, accept or negotiate the LC. To have LC opened, first we ask Client to fill in Application form to get Free LC Draft for your deal from the most appropriate bank.

With traditional banks, for instance, you may have a hard time getting approved if you have bad credit.

For seller protection, if the buyer is Again for buyer protection if delivery does not happen then the buyer gets his payment by using A restricted LC is that one wherein the specific bank is designated to pay, accept or negotiate the LC.

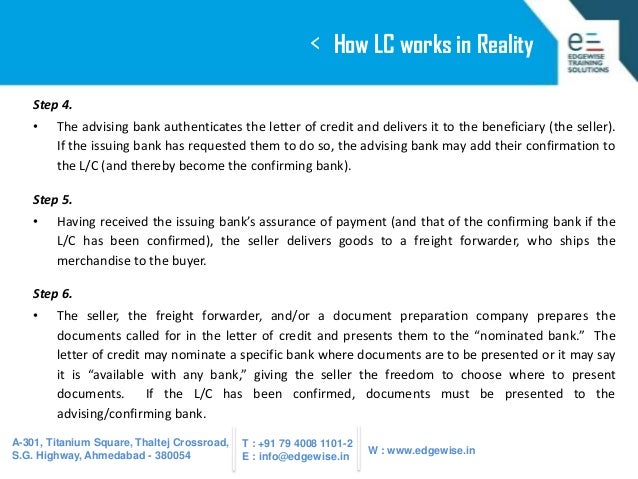

No matter how many advantages letters of credit have, they have one big disadvantage. Under this payment terms, the seller gets paid and the buyer and the seller exchange the documents representative of the goods and the How to issue an LC. Then Client send it to his Seller to confirm.